1/30-2/3: 経済指標は製造業の失速と労働市場の逼迫、主力ハイテク決算は予想未達が目立ったが、FOMC及びパウエル議長のハト派姿勢が顕著な株高に

今週回顧と来週展望

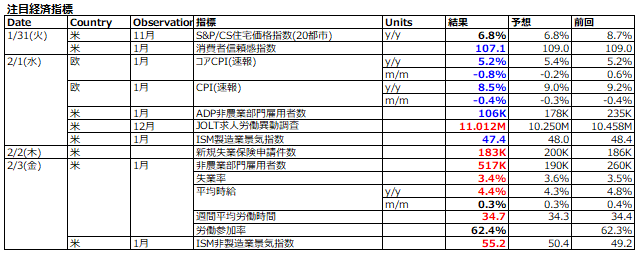

米経済指標は、落ち込みが続く製造業と堅調ぶりを示す非製造業で対照的な数字の一方、雇用市場は総じて逼迫状況が確認された。インフレが欧州でも減速が鮮明となる中、BOE及びECBの政策決定会合では予想通りの利上げ決定も、利上げサイクルがピークに近いことが示唆された。しかし、強すぎる雇用統計を受けて、期待インフレは低下も実質金利は上昇した。主力ハイテク決算は、予想未達から弱さが目立った。

尤も、インフレ減速の明確化を好感して上げてきた米株価も、週末の雇用統計が強すぎたことから、リセッション懸念の後退と見た強気筋とインフレ減速の後退懸念と見た弱気筋の対立は続くか?

FOMC後の最初の当局者発言となったデーリー総裁は、「追加引き締めと景気抑制的なスタンスを当面維持するというのが政策の方向」と話している。

来週はブラックアウト明けでパウエル議長を含む複数のFRB高官講演が予定されており、強烈な強さを示した雇用統計を受けた後でどのような姿勢を示すか注目される。国内は何と言っても、2/10の提示が強く意識されている日銀総裁人事案。米株に比べ頭を押さえられた感が強い日本株だが、順当に雨宮氏なら円安&株高、サプライズ人事の山口氏なら円高&株安が市場のコンセンサス的な見方。米株高&米ドル安あるいは米株安&米ドル高で、日本株の動きは米株に比べて上下に限定的であったが、日銀総裁のサプライズ人事でもあると、米株安&円高で日本株の下げが増幅される可能性もあり、なかなかに不確実性が高い。

FOMC当日の値動き

パウエル議長は、年内の利下げは念頭にないとしながらも、市場の楽観を厳しく戒めるような明確な牽制発言をしていない。また、現状のインフレ減速と堅調な労働市場の組み合わせを自画自賛し、ソフトランディングへの自信も深ている様子。一方で、今後、利上げの累積効果によって経済のオーバーキル懸念が高まるようであれば、政策は柔軟に対応するオプション、すなわち緩和転換も有り得ると示唆したことも好材料。

FOMC声明文にいくつもの変更が加えられるのは稀だが、今回は以下の3点が注目された変更箇所である。尚、「継続的な利上げが適切」との文言は不変であった。

1. インフレ認識: これまでの「インフレ高止まり」から「インフレが幾分緩和」が加わり、インフレ減速を明確に認める格好に。

2. 露宇紛争のインフレへの影響: 実際のところ、インフレはコロナ・パンデミック以降の巨額の現金給付がきっかけとなって高進したが、インフレの起因を露宇紛争にも求めるFRBがようやくインフレ寄与から除外。

3. 政策金利の軌道見通し: これまでは、「利上げのペース」を念頭に置いた利上げ継続前提の声明であったが、「利上げの程度」と変更したことから、利上げ停止も有り得るとの解釈が可能に。

2023/2/1

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation has eased somewhat but remains elevated.

Russia's war against Ukraine is causing tremendous human and economic hardship and is contributing to elevated global uncertainty. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/2 to 4-3/4 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

2022/12/14

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Russia's war against Ukraine is causing tremendous human and economic hardship. The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/4 to 4-1/2 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

本内容にある過去データ及び将来の見積、予測、予想に関する情報が正しいとは限りません。また、本内容は特定の銘柄、取引を推奨するものではありません。取引に当たっては、ご自身のご判断でお願いします。売買で被られた損失に対し、著者は何らの責任も持ちません。